The 2022 Inflation Reduction Act has brought a lot of changes to the tax laws of the United States. Among these changes is the extension of the tax credit for residential energy-efficient property, including heat pumps. If you are planning to install a heat pump, it is important to understand the details of the tax credit and how to qualify for it.

What is the Heat Pump Tax Credit?

The heat pump tax credit is a federal tax credit that allows homeowners to claim a credit for a portion of the cost of installing a qualified energy-efficient heat pump system in their home. The credit is designed to encourage the adoption of energy-efficient technologies and reduce carbon emissions.

Under the 2022 Inflation Reduction Act, the heat pump tax credit is equal to 30% of the cost of the qualified equipment, including installation costs, up to $2000 maximum. This credit can be claimed each calendar year for a qualified equipment installation in that year.

Qualifying for the Heat Pump Tax Credit:

To qualify for the heat pump tax credit, your heat pump system must meet certain requirements. First, the system must be installed in your primary residence, which means that it cannot be installed in a rental property or a second home. The system must also be a qualified energy-efficient heat pump, which means that it meets certain energy efficiency standards set by the government.

The efficiency requirements are defined in terms of the new 2023 DOE efficiency standards and definitions. These changes are outlined in this memo.

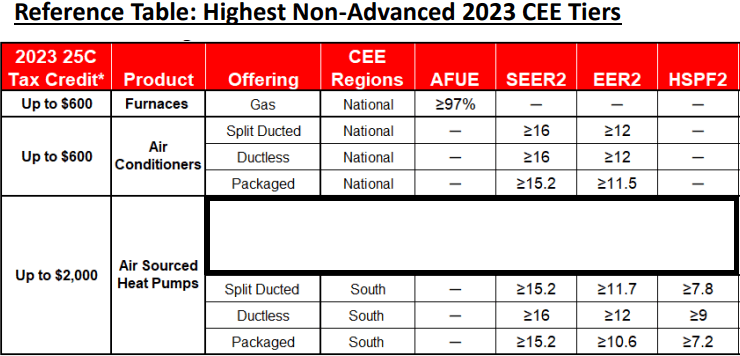

The requirements for a qualified energy-efficient heat pump depend on the type of system you are installing. This table outlines the requirements. The requirements vary for ducted package units and split systems, and ductless mini-split systems.

It is important to note that the tax credit only applies to the cost of the qualified equipment and installation, not to any other costs associated with the installation, such as permits, ductwork, or electrical upgrades. Further information regarding this tax credit may be found here.

Claiming the Heat Pump Tax Credit:

Please consult your tax professional on how to claim the tax credit. You must file the appropriate IRS form with your tax return. You will need to provide information about the qualified energy-efficient property you installed, including the make and model of the system and the total cost of the equipment and installation. Blue Ridge Heating and Air will provide this documentation for any qualified system that we install.

Conclusion:

The heat pump tax credit is a valuable incentive for homeowners to invest in energy-efficient technologies and reduce their carbon footprint. If you are planning to install a heat pump in your home, it is important to ensure that your system meets the requirements for the tax credit and that you keep accurate records of the cost of the equipment and installation. By claiming the tax credit, you can not only save money on your taxes but also enjoy the benefits of a more energy-efficient and comfortable home.